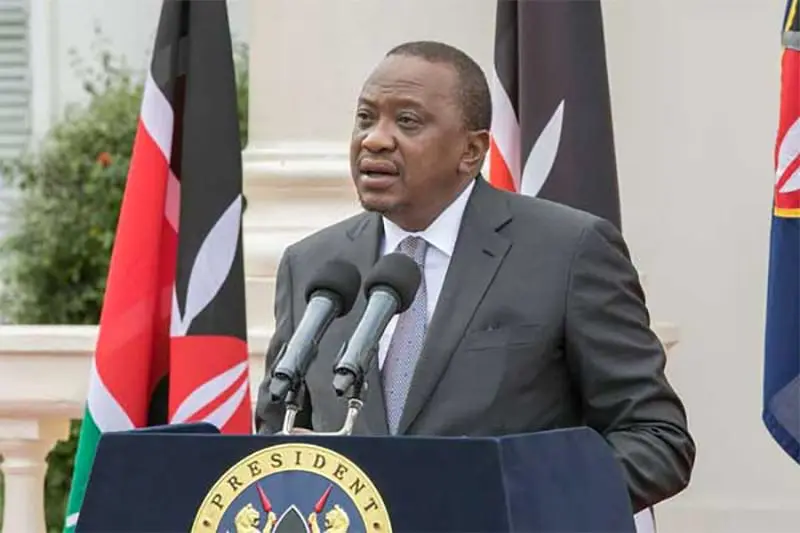

On September 21, just a day after chaotic scenes marred the passing of the Finance Bill 2018 by the National Assembly, Kenyan President Uhuru Kenyatta put pen to paper, triggering the bill’s passage into law.

Kenyan punters feel the pinch as President Kenyatta signs new tax laws

On September 21, just a day after chaotic scenes marred the passing of the Finance Bill 2018 by the National Assembly, Kenyan President Uhuru Kenyatta put pen to paper, triggering the bill’s passage into law.

The new radical taxation measures are meant to help the government raise Sh130 Billion (USD 1.3 Billion) to address the current budget deficit after the Kenya Revenue Authority (KRA) registered a slump in revenue collection.

Although President Kenyatta, through a memorandum forwarded to the National Assembly, recommended for the reduction of gaming tax from 35% to 15%, one which was approved, the burden has unequivocally been transferred to punters.

In what the government termed as a valiant effort to enhance equity and balance in taxation, the new tax laws have seen the introduction of a 20% tax on all winnings from betting, gaming, lotteries and prize competitions in Kenya.

Through expanding the net tax on winnings, the government hopes to raise Sh25 billion (USD 250 Million) from the current Sh8.7 Billion (USD 87 Million) collected from the gaming industry.

Cosmas Korir will unreservedly be one of the first people to feel the pinch of the new tax laws. Korir, who just three weeks ago worked as a Director of Agriculture in West Pokot County, recently won the Mega SportPesa Jackpot of Sh208 Million (USD 2.08 Million). He as such owes the taxman a staggering Sh41.6 Million (USD 416,000) in fulfillment of his tax obligations as per the newly passed laws.

Korir promised to share his winnings with two other friends who predicted five games apiece while he tried his luck with the remaining seven, although that remains to be seen given the radical nature of the revised taxes.

The former parliamentary aspirant predicted all 17 games correctly to become only the fourth Kenyan to win the Mega jackpot, after Samuel Abisai won Sh221 Million (USD 2.21 Million) in May last year, while three other winners shared Sh115 million (USD 1.15 Million) a month later.

Gordon Ogada holds the record for striking the biggest pot of gold in SportPesa history, as he took home Sh230 Million (USD 2.3 Million) in February this year.

BetOnline

$5,000

Get up to $250 in Free Bets with no strings attached, plus 100 Free Spins.

Treasury Cabinet Secretary Henry Rotich also raised excise duty on all mobile money transfers from the previous 10% to 12%, whilst also introducing a 15% excise duty on telephone and internet data services.

This is in addition to the excise duty charged on all bank fees and other money transfer services that have risen by 10%: all this to aid in raising Sh20.2 Billion (USD 202 Million) of the Sh130 billion (USD 1.3 Billion) deficit.

The ominous tax measures to a great degree seems to have targeted the gambling industry, with the revised excise duty on internet data services and mobile money transfer services meant to discourage the prevailing betting culture among the Kenyan youth.

Regional telecommunication powerhouse Safaricom have recently reviewed prices for mobile data bundles, Fibre-To-The-Building (FTTB) and Fibre-To-The-Home (FTTH), as have Airtel and Telkom: Kenyans expected to feel the full pinch of the new tax laws when subscriptions expire at the end of the month.

Reduction of the gaming tax by 20% however spells delight for Kenya Rugby Union (KRU), Boxing Association of Kenya and Nakuru All Stars who could all see their SportPesa sponsorship reinstated.